The Capital One Venture X card is the best one size fits all credit card. The Capital One Venture X card gives a flat 2x miles on every purchase, 5x miles on flights booked through Capital One Travel, and 10x miles on hotels and car rentals booked through Capital One Travel! Credits and benefits outweigh the annual fee, so it’s a no brainer even if you only travel once per year!

Table of Contents Hide

Review

The Capital One Venture X card is not about thinking hard to maximize categories for different spent. It is a card that gives a flat 2x miles for every purchase, taking the stress out of which card should be used for different scenarios. There are no foreign transaction fees, so there are no concerns when traveling internationally. There is a single bonus multiplier of 2x when swiping the card, so for people who want one premium card and want to stop, this is the card for you.

Who is this card for?

This card is for people who only want to carry one card and want to enjoy premium travel benefits for themselves or the whole family.

The Venture X card does have a downgrade path. You should in theory (the card has been out for less than a year at the time of this writing, so there is not much data on this) be able to downgrade to the original Venture card if you want to keep transfer partners as an option for $95. Additionally, you should be able to downgrade to the Capital One VentureOne Rewards card, which has a $0 annual fee. Capital One has a few cards that can collect Capital One Miles, but only the premium ones with an annual fee can transfer miles to partners.

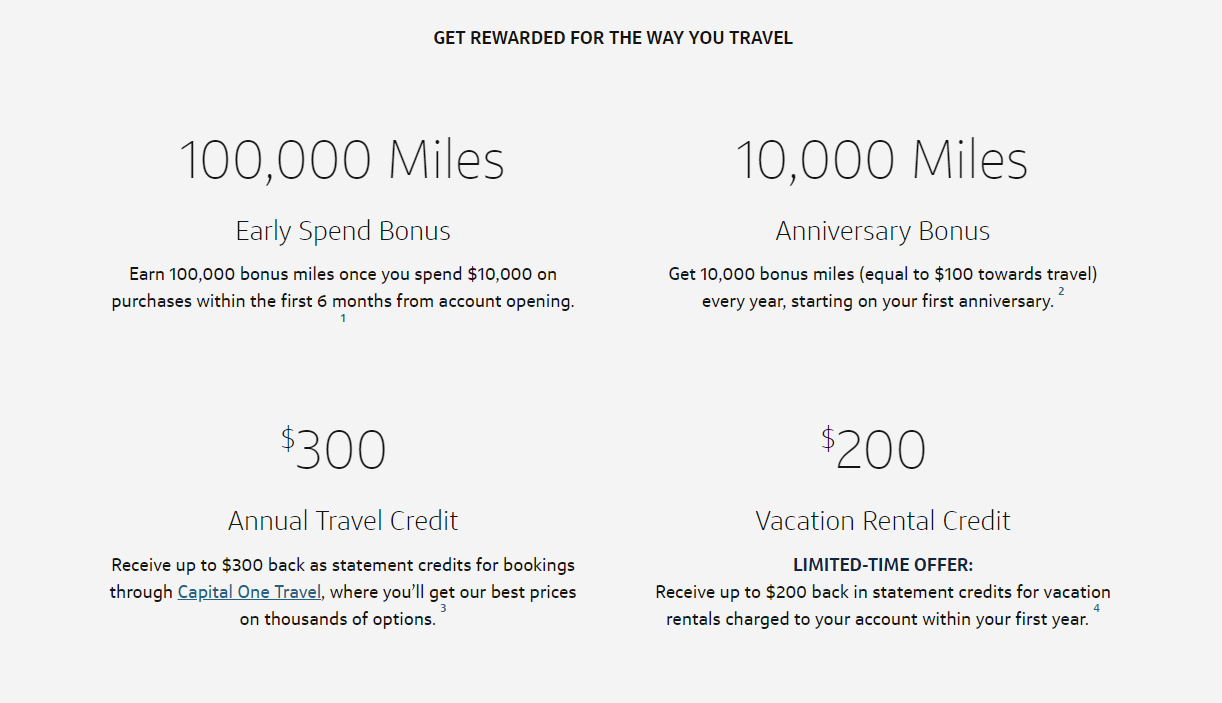

The Venture X card has a high annual fee of $395, but similarly to the Hilton Aspire, this card has more credits than its annual fee, making it a no-brainer for someone who travels or wants to start traveling. The first credit is a $300 travel credit, which can be used to book hotels, flights, cruises, or anything that can be booked via the Capital One Travel portal. This next credit is only usable once every 4 years, which is a credit for Global Entry/TSA PreCheck. This other credit is more of an annual renewal benefit, in the form of 10,000 Capital One Miles each year. If you simply use these miles to buy travel on the Capital One travel portal, it is worth 1 cent per mile. This means that you’re getting $400 of credit (minimum, you can get more by using transfer partners; check out Capital One Miles points guide) each year for a $395 annual fee. In the first year, that is $500 worth of credit if you use the Global Entry/TSA PreCheck credit. In addition to all of that, in the first year of owning the card, assuming you get the 100k sign up bonus, that is $1500 minimum value for a $395 annual fee.

The card is net positive each year, but also has some other common premium card features as well. This includes a Priority Pass Select Membership, which grants access to over 1,300 lounges worldwide. Unlike most premium cards though, you can add authorized users for free; these authorized users also get a Priority Pass Select Membership. This is especially great for families. In a family of four with most other premium credit cards, you would need to pay for an authorized user so that all four family members can get into a lounge (you can only bring 2 guests per membership) or have someone not go in. With the Venture X, the owner can make one other person an authorized user for free and then that person will get a membership, allowing them to also bring in 2 additional guests. This would allow for a family of up to six to get into a Priority Pass lounge at no additional cost. The Capital One Venture X card also allows discounts at Priority Pass restaurants and experiences. The Capital One Venture X card also grants unlimited access to Capital One lounges. These are new lounges and are operated by the excellent chain “Plaza Premium”.

Overall this card is probably the best card released in 2021 and remains that way even now.

Multipliers

10x Capital One Miles on Hotels and Rental Cars booked through Capital One Travel

5x Capital One Miles on Flights booked through Capital One Travel

2x Capital One Miles on any purchase

Benefits

$300 Travel Credit for use with Capital One Travel

10,000 miles on renewal

Hertz President’s Circle® status

No foreign transaction fee

Various travel, shopping, and phone Insurance

1 to 1 Transfer Partners

Priority Pass Select Membership Capital One Lounge Access

One of the best benefits of the Capital One Venture X card is access for you and two guests to the huge selection of Priority Pass lounges, which are located across the world. Priority Pass is comprised of over 1,300 lounges, spread across 600 airports in about 150 countries. Each Priority Pass lounge varies in size, quality, and hours, but most of them provide some level of food, beverages, Wi-Fi, showers, conference rooms, kids area, and other features. As mentioned above, Priority Pass typically only allows access for the cardholder and two guests, and any additional guests will have to pay an entrance fee, typically around $30.

Unique to Capital One Venture X credit card is unlimited access to the Capital One lounges for the cardholder and up to 2 guests. I have visited the one in Dallas and I can personally say it is better than the Dallas Centurion Lounge. It offered numerous options for food, ample seating space for work and relaxation, a Peloton and yoga room, sleep rooms, bidets in the bathrooms, and everything I would expect from a nice lounge in Asia. As of Jan 2022, there are 3 planned lounges including the one open in Dallas right now.

Dallas/Fort Worth: Relax and unwind in the Lounge, located in Terminal D by Gate D22. Now open 6 a.m. to 9 p.m. daily. View the map here.

Washington - Dulles: Recharge just outside the nation’s capital. You'll find the Capital One Lounge in the Main Terminal, directly after TSA PreCheck. Opening 2022.

Denver: Find calm among the clouds in the Mile High City. Just head to Concourse A on the Mezzanine Level. Opening 2022.

Capital One Lounge, Dallas Fort Worth Airport

Capital One Lounge, Dallas Fort Worth Airport

Capital One Lounge, Dallas Fort Worth Airport

Capital One Lounge, Dallas Fort Worth Airport

Capital One Lounge, Dallas Fort Worth Airport

Capital One Lounge, Dallas Fort Worth Airport

Some of the Priority Pass lounges are operated by an airline, such as the Turkish Airlines Lounge at Dulles International Airport. This lounge is typically regarded as the best Priority Pass lounge in the United States, and comes with a buffet, cocktail bar, several rooms to spread out to relax before your flight, showers, a prayer room, and views of the runway. Some of the Priority Pass lounges are operated by a group, such as the collection of The Club lounges, which are spread across the United States and United Kingdom. The Club lounges are typically fairly standard across all of their locations, and are more limited in features as compared to some of the airline branded lounges.

In addition to the lounges, your Priority Pass Select membership comes with dining credits at about 30 US airport restaurants, and about 40 international airport restaurants. Each restaurant is slightly different, but the typical credit is $28/person at one of these restaurants. Additionally, Priority Pass Select members can register a guest visiting with them to receive an extra $28 discount. Just remember to tip on the pre-discounted food price! Restaurants vary from casual food, such as Johnny Rockets at Syracuse International Airport, to steakhouses, such as Bobby Van’s Steakhouse at JFK International Airport. This dining credit also extends to other unique locations, such as Minneapolis International Airport’s PGA restaurant and indoor golf experience, and Dallas-Fort Worth International Airport’s video game lounge.

Insurance and Travel Benefits

If something happens while you’re on a trip, it is definitely good to have travel insurance.

The Venture X card comes with:

Primary Car Rental Insurance

Trip Delay Reimbursement

Travel Accident Insurance

Trip Cancellation Insurance

Lost Luggage Reimbursement

Cell Phone Insurance

Price Drop Protection

Before you go on a spending spree for lost luggage or one of the items that appears to be listed here or on the benefits page, please call the benefit’s administrator for Capital One (1-844-288-2140) customer service to be sure that your situation meets their requirements.

Summary

The Capital One Venture X card is a great premium card that offers all the major perks expected plus more. It has more credits than the annual fee and can easily work for anyone as a single card setup. Overall, I think that if you could have one card, and only one card, my choice would be the Capital One Venture X card.